Office Hours

Insurance Products Offered

Auto, Homeowners, Condo, Renters, Personal Articles, Business, Life, Health, Pet

Other Products

Banking, Investment Services, Annuities

Would you like to create a personalized quote?

Lindsay Goebel

Office Hours

Address

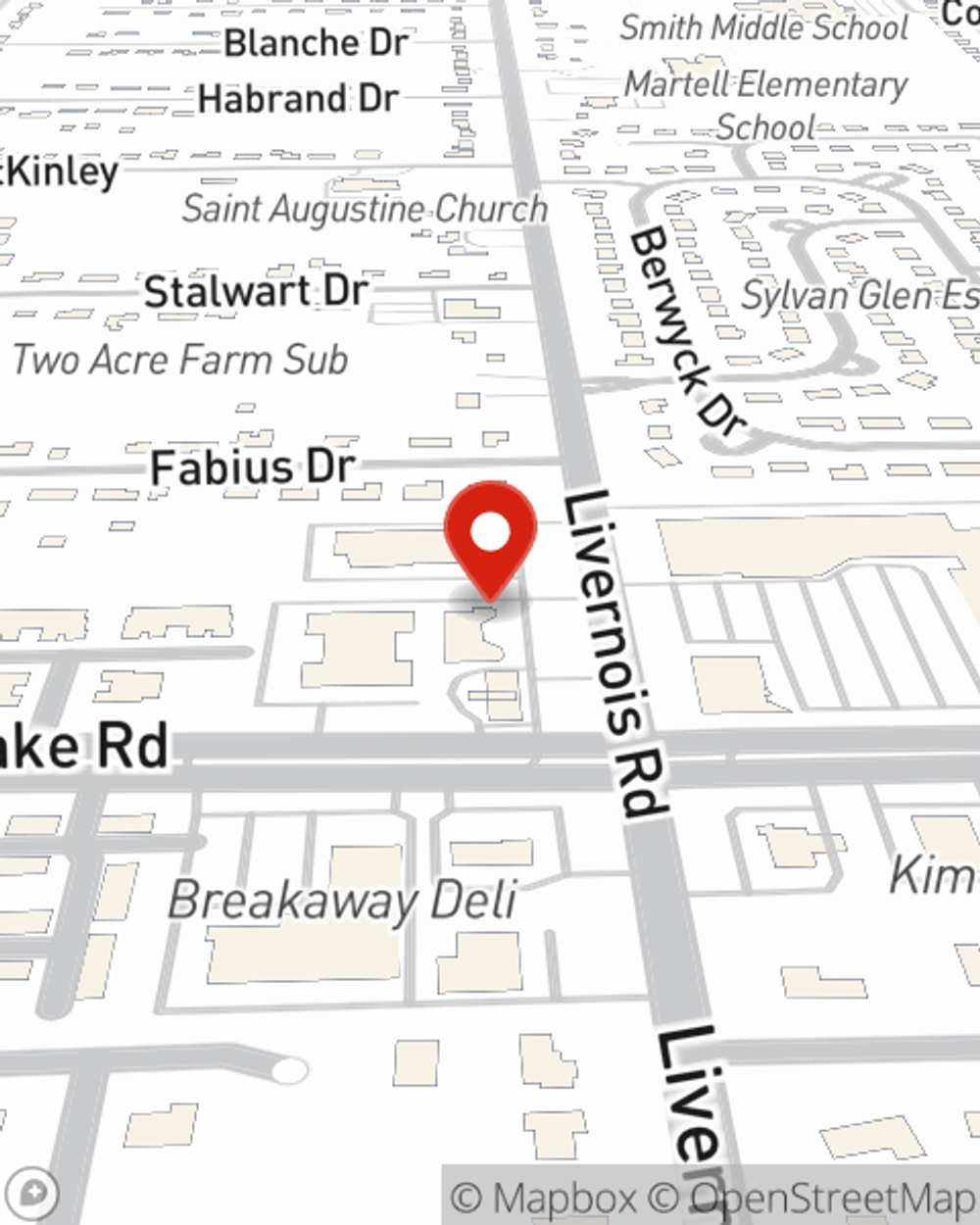

Troy, MI 48098

Northwest corner of Long Lake Rd. and Livernois Rd. intersection, next to the Mobile Gas Station

Office Hours

Insurance Products Offered

Auto, Homeowners, Condo, Renters, Personal Articles, Business, Life, Health, Pet

Other Products

Banking, Investment Services, Annuities

Would you like to create a personalized quote?

Office Info

Office Info

Office Hours

-

Phone

(248) 250-6800 -

Fax

(248) 250-6817

Languages

Insurance Products Offered

Auto, Homeowners, Condo, Renters, Personal Articles, Business, Life, Health, Pet

Other Products

Banking, Investment Services, Annuities

Office Info

Office Info

Office Hours

-

Phone

(248) 250-6800 -

Fax

(248) 250-6817

Languages

Simple Insights®

Avoid these risks or you may fall asleep at the wheel

Avoid these risks or you may fall asleep at the wheel

Help prevent drowsy driving by knowing the dangers, identifying warning signs and learning about technology that could prevent accidents caused by driver fatigue.

The Real Consequences of Drunk Driving

The Real Consequences of Drunk Driving

What's at stake if you're caught drunk driving? A lot. These tips help you avoid the dangers of drinking and driving.

Chillin’ and grillin’: Check out our safety tips for outdoor grilling with charcoal and gas

Chillin’ and grillin’: Check out our safety tips for outdoor grilling with charcoal and gas

Help prevent accidents and disasters by knowing the risks, knowing what to watch out for and by following the steps for safe grilling.

Social Media

Viewing team member 1 of 4

Betty Abebe

Customer Service Manager

License #20526675

Betty joined our team in 2023 and has quickly established herself as a go-to resource for our customers. Known for going above and beyond, she excels at assisting with claims, billing issues, and new policies, ensuring a smooth and supportive experience for everyone. Betty's warm personality and engaging conversations have made her a favorite among customers, many of whom stop by just to chat. Outside of work, she loves to travel and cherish time with her family members scattered around the globe. Her commitment to service and genuine connections make her an invaluable part of our team!

Viewing team member 2 of 4

Madeline Godwin

Account Manager

License #20888887

Madeline joined our team in 2023 and quickly became known for her passion for helping customers protect what matters most to them. With a strong focus on life insurance and other financial, products, she is dedicated to guiding customers through their options with care and expertise. Beyond her professional commitments, Madeline is a talented artist and professional dancer, who enjoys choreographing performances and showcasing her skills in theater during her free time. Her creativity and dedication to both her customers and her art make her a unique and valuable member of our team!

Viewing team member 3 of 4

Megan Alexsandrowski

Account Manager

License #20242058

Megan joined our team in late 2024, bringing with her several years of valuable insurance experience from both State Farm and an independent agency. With a passion for helping new customers secure the better protection for their needs, she is dedicated to providing exceptional service and guidance. Outside of the office, Megan enjoys spending quality time at home with her three beloved cats. Her commitment to our customers and her love for animals make her a wonderful addition to our team!

Viewing team member 4 of 4

Tori Jackson

Account Manager

License #21445068

Tori brings a wealth of experience to our team, having spent several years honing her business skills in customer service and relationship building. Recently transitioning into the insurance industry, she has quickly become a valuable asset with her eagerness to learn and adapt. Tori is known for her dedication to going above and beyond for our customers, ensuring they receive the wonderful support and guidance. Her positive attitude and commitment to excellence make her a fantastic addition to our team!

Troy, MI Full Time

Troy, MI Full Time

Troy, MI Full Time

Troy, MI Full Time

Troy, MI Full Time

Troy, MI Full Time

Troy, MI Full Time